In modern mobile payment ecosystems, Android applications are no longer “thin clients.” They participate actively in data capture, encryption, authentication, and transaction orchestration. As a result, an Android app can significantly expand or reduce PCI-DSS scope depending on how it is architected.

This checklist is aligned with PCI DSS v4.0.1, the active standard as of 2025, and focuses on practical, Android-specific controls that help meet compliance while reducing real-world risk.

1. Scope Control: The Most Important Design Decision

The fastest way to reduce PCI exposure is scope minimization.

Recommended architectural principles

- Avoid handling Primary Account Number (PAN) inside the Android app wherever possible.

- Prefer hosted payment pages, redirect-based flows, or payment provider SDKs that ensure card data never traverses app memory or backend services.

If PAN entry is unavoidable, ensure:

- PAN is transmitted directly to the payment gateway

- Backend services receive tokens only, never raw card data

- Sensitive Authentication Data (SAD) such as CVV, PIN blocks, or track data must never be stored post-authorization.

Outcome: A well-designed Android app can remain out of the Cardholder Data Environment (CDE).

2. Data Flow Mapping (Non-Negotiable)

Before controls are applied, data movement must be understood.

Maintain a living inventory of:

- Screens where PAN or tokens may appear

- Data paths: UI → memory → network → SDK → backend

Secondary channels:

- logs

- analytics

- crash reporting

- screenshots

- clipboard

- autofill and accessibility services

This document becomes core PCI evidence and is critical during audits.

3. Protect Stored Account Data (PCI Requirement 3)

The strongest control is non-storage. When storage cannot be avoided, Android must enforce cryptographic isolation.

Android storage rules

Never store PAN in:

- SharedPreferences / DataStore

- SQLite / Room

- files, cache, screenshots, logs

- Store provider tokens only, never real card numbers

- All sensitive material must be encrypted using keys protected by Android Keystore

Example: AES key generation using Android Keystore

val keyGenerator = KeyGenerator.getInstance(

KeyProperties.KEY_ALGORITHM_AES,

"AndroidKeyStore"

)

val keySpec = KeyGenParameterSpec.Builder(

"pci_aes_key",

KeyProperties.PURPOSE_ENCRYPT or KeyProperties.PURPOSE_DECRYPT

)

.setBlockModes(KeyProperties.BLOCK_MODE_GCM)

.setEncryptionPaddings(KeyProperties.ENCRYPTION_PADDING_NONE)

.setUserAuthenticationRequired(false)

.setKeySize(256)

.build()

keyGenerator.init(keySpec)

keyGenerator.generateKey()

Additional hardening

- Use hardware-backed keystore where available

- Disable automatic backups:

<application

android:allowBackup="false"

android:fullBackupContent="false">

</application>

- Prevent screenshots on sensitive screens:

window.setFlags(

WindowManager.LayoutParams.FLAG_SECURE,

WindowManager.LayoutParams.FLAG_SECURE

)

4. Encrypt Data in Transit (PCI Requirement 4)

All card-related traffic must be encrypted using strong cryptography.

Android network controls

- Enforce TLS 1.2+ (prefer TLS 1.3)

- Block cleartext traffic at OS level

- Harden WebView traffic

- Apply certificate pinning for payment and authentication endpoints

Example: Network Security Config

<network-security-config>

<base-config cleartextTrafficPermitted="false">

<trust-anchors>

<certificates src="system" />

</trust-anchors>

</base-config>

</network-security-config>

Certificate pinning (OkHttp example)

val certificatePinner = CertificatePinner.Builder()

.add("api.payment.com", "sha256/AAAAAAAAAAAAAAAAAAAA...")

.build()

val client = OkHttpClient.Builder()

.certificatePinner(certificatePinner)

.build()

Important: Always maintain a pin rotation strategy to avoid production lockouts.

5. Secure Development Lifecycle (PCI Requirement 6)

PCI DSS v4.x places strong emphasis on secure software development.

Mandatory practices

- Threat modeling for all payment flows

- Secure coding aligned with modern mobile security baselines

Dependency governance:

- version pinning

- removal of abandoned libraries

- SBOM generation

Secrets management:

- no API keys inside APK

- use short-lived backend-issued tokens

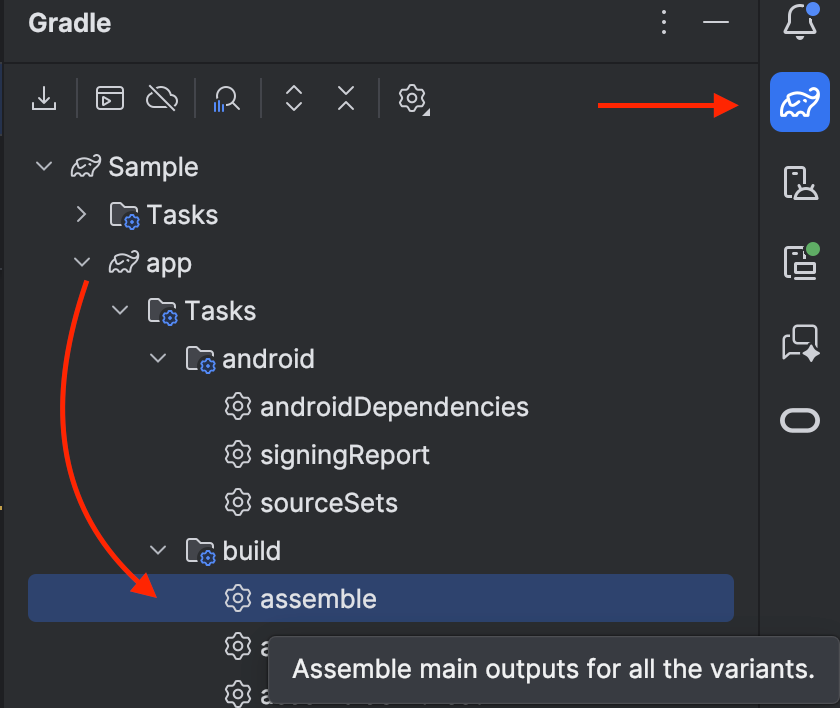

- Release hardening:

- R8 / ProGuard enabled

- debug logs stripped

- debuggable flag disabled

6. Vulnerability Management & Testing (PCI Requirements 6 & 11)

Required testing layers

- Static analysis for Kotlin/Java

- Dependency vulnerability scanning

Mobile penetration testing:

- runtime instrumentation

- MITM attempts

- rooted/emulator environments

- Continuous patching discipline with defined SLAs

Runtime abuse detection (example signal)

val isDebuggerAttached = Debug.isDebuggerConnected()

if (isDebuggerAttached) {

// Raise risk signal, do not rely on this as sole control

}

Client-side signals are risk indicators, not enforcement mechanisms.

7. Access Control & Authentication (PCI Requirements 7 & 8)

Android-specific expectations

- Device identity ≠ user identity

- Use OAuth2 / OIDC patterns with short-lived access tokens

- Secure refresh token storage via Keystore

Step-up authentication for:

- adding cards

- refunds

- payout changes

- Enforce session expiry and inactivity timeouts

8. Logging, Monitoring & Log Hygiene (PCI Requirement 10)

Non-negotiable rules

- Never log PAN or SAD (even masked incorrectly)

Sanitize:

- network logs

- analytics events

- crash reports

- Use correlation IDs instead of payload duplication

Example: Safe logging

Log.i("PaymentEvent", "Transaction started, id=$transactionId")

Never log request or response bodies that may contain payment data.

9. Third-Party SDK & Payment Software Responsibility

- PA-DSS is retired; payment software now falls under Secure Software and Secure Software Lifecycle standards.

- Clearly document:

- what the Android app is responsible for

- what the payment SDK/provider secures

- Treat third-party SDKs as extensions of your attack surface

10. Audit-Ready Evidence Checklist

Maintain the following artifacts:

- PCI scope definition & data-flow diagrams

- Proof of non-storage of PAN/SAD

- Keystore usage documentation

- TLS and pinning configuration

- Secure SDLC records

- Penetration test reports with remediation tracking

These artifacts convert compliance from a last-minute scramble into a predictable process.

Closing Note

PCI-DSS compliance for Android applications is not a checkbox exercise and not something that can be “patched in” before an audit. It is the outcome of intentional architectural decisions, strict data-handling discipline, and continuous security validation.

Well-designed Android apps:

- aggressively minimize PCI scope

- avoid storing sensitive card data entirely

- treat runtime security as a layered risk model

- align engineering practices with evolving PCI standards

When compliance is embedded into design, it stops being a blocker — and becomes a competitive reliability signal for payment platforms operating at scale.

PCI-DSS Compliance Checklist for Android Apps was originally published in ProAndroidDev on Medium, where people are continuing the conversation by highlighting and responding to this story.

This Post Has 0 Comments